Trends in HIV Preexposure Prophylaxis Utilization and Spending Among Individuals with Commercial Insurance

Abstract

In a cross-sectional analysis of HIV preexposure prophylaxis (PrEP) utilization by commercially insured patients from 2019 to 2021, most prescriptions were for branded formulations of PrEP despite the availability of a generic version. Accounting for the modest relative clinical benefit of branded TAF/FTC (tenofovir alafenamide fumarate/emtricitabine) PrEP over generic TDF/FTC (tenofovir disoproxil fumarate/emtricitabine) PrEP, use of generic TDF/FTC PrEP would have reduced commercial insurers’ spending by 33%.

Introduction

In October 2019, Descovy (tenofovir alafenamide fumarate/emtricitabine; TAF/FTC) received an indication for HIV prophylaxis, the second drug to do so following Truvada (tenofovir disoproxil fumarate/emtricitabine; TDF/FTC) [1]. Descovy is a prodrug of Truvada whose clinical development was delayed to coincide with the expiry of Truvada patents [1], a technique often called ‘product-hopping [2]’. Descovy offers an extremely modest clinical improvement over TDF/FTC; switching all current preexposure prophylaxis (PrEP) patients from TDF/FTC to Descovy would generate a 5-year 0.1% increase in QALYs, meriting only a $370 annual premium [3]. Generic TDF/FTC was released in August 2020; in 2021, list prices for generic TDF/FTC were less than $1 per pill while branded Truvada cost $61 and Descovy cost $64 [4].

Existing estimates of PrEP utilization are generally across market sectors [5]. This article presents the first disaggregation of PrEP utilization by formulation in the commercially insured market and estimates unnecessary spending on Truvada and Descovy instead of generic TDF/FTC. Prior commentary suggested 340B Program providers may over-prescribe Descovy instead of generic TDF/FTC because of greater revenue on the brand product [6]; we compare utilization by 340B status.

Methods

We used Healthcare Cost Institute (HCCI) claims data for employer-sponsored insurance to assess PrEP utilization from 2019 to 2021 by formulation. HCCI data includes approximately 55 million commercially insured individuals across all 50 states, about one-third of all individuals with employer-sponsored insurance [7]. We identified all patients with a claim for Descovy, Truvada, or generic TDF/FTC in each year and omitted any patients who had any claims for a separate antiretroviral during the calendar year to exclude those under HIV treatment. We identified 340B claims by linking the prescriber practice location to the 340B covered entity database using an established method [8]. To estimate 2021 excess spending on Truvada and Descovy, we first established the cost-effective price for Descovy by amortizing the $370 annual cost-effectiveness premium identified in the literature for TAF/FTC relative to TDF/FTC to the observed mean unit cost of generic TDF/FTC [3]. We note that the authors of this cost-effectiveness estimate for TAF/FTC over TDF/FTC describe it as ‘an extreme upper bound’ for the incremental value of TAF; therefore, we consider our estimates to be conservative. We then subtracted the cost-effective price for Descovy from the observed mean unit cost of Descovy and also subtracted the observed mean unit cost of generic TDF/FTC from the observed unit cost of Truvada; we then multiplied the excess per-unit costs by total units of Descovy and Truvada to estimate excess spending.

Results

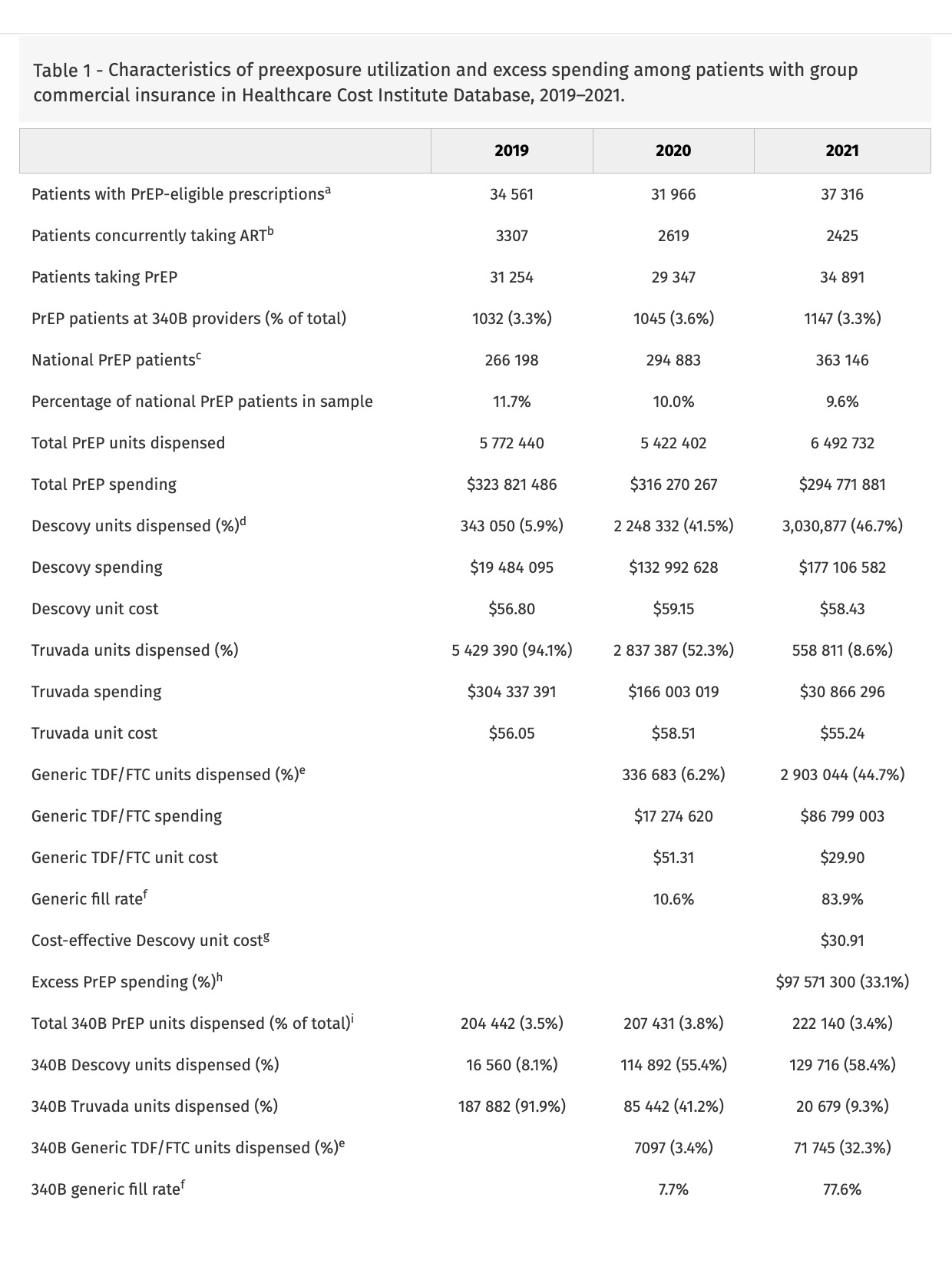

In 2021, 37 316 sample patients used a PrEP formulation; 2425 had other antiretroviral use, leaving 34 891 sample patients (9.6% of national PrEP patients [9]) (Table 1). In 2021, 1147 (3.3%) of patients received PrEP from 340B providers.

In 2019, 5.9% of PrEP units dispensed were for Descovy, increasing to 41.5% in 2020 and 46.7% in 2021. Truvada units were 94.1% in 2019, falling to 52.3% in 2020 and 8.6% in 2021. Generic TDF/FTC grew from 6.2% of units in 2020 to 44.7% in 2021.

340B providers had higher rates of Descovy prescribing (58.4%) than providers overall in 2021. However, 340B providers only accounted for 3.4% of PrEP units dispensed in 2021.

Commercial insurers in the sample spent $295 million on PrEP in 2021, with $177 million spent on Descovy, $31 million on Truvada and $87 million on generic TDF/FTC (Table 1). Relative to the cost-effective premium on generic TDF/FTC, sample insurers overpaid $83 million on Descovy (47.1%). Relative to the generic price, sample insurers overpaid $14 million on Truvada (45.9%).

Discussion

In this analysis of trends in PrEP utilization in the commercial insurance market, providers substantially overprescribe Descovy relative to clinical value. Though differences between Descovy and generic TDF/FTC are not clinically meaningful, Descovy utilization was nearly half of 2021 commercial PrEP utilization and was 60% of spending. Although 340B providers prescribe Descovy at elevated rates, presumably because of the higher revenue realized on branded versus generic PrEP, 96% of Descovy PrEP prescriptions for commercially insured patients are written by non-340B providers; given this low 340B market share, 340B program reforms may have nominal effects on PrEP spending. This low 340B prescribing rate may be attributable to site of care for commercially insured PrEP users, 79% of which access PrEP through primary care [10]; prior work has shown that, in 2012, less than 0.5% of prescriptions dispensed through chain pharmacies were 340B-eligible [11]. Low 340B use may also be attributable to the growth of online PrEP prescribing that would likely be ineligible for 340B use; one such program, MISTR, which focuses on PrEP, reported 150 000 patients in 2023 (though it is unclear how many are being prescribed PrEP) [12]. For the 10% of national PrEP utilization contained in our sample, replacing spending on Descovy and Truvada with generic TDF/FTC would have reduced commercial insurance costs by $98 million, 33% of their spending on PrEP.

Acknowledgements

Authors’ roles: S.D. is responsible for study design, interpretation of results, and drafting of the article. K.J. is responsible for data analysis.